Hello financial advisors!

At Empire Marketing Partners, we’re committed to arming you with the insights and strategies needed to provide exceptional value to your clients.

The latest BlackRock’s 2024 Read on Retirement report offers us a panoramic view of Americans’ current retirement readiness and sentiments.

Here’s a rundown of the key points and stats, along with strategies for helping your clients achieve peace of mind.

Key Points & Retirement Planning Strategies for Financial Advisors

Workers’ Confidence is High, But Many Don’t Know How Much to Save

Stats

According to the report, 68% of savers with access to a workplace retirement plan believe they are on track with their retirement savings, reflecting an increase of 12% from last year.

Despite this improved confidence, 43% of respondents remain uncertain about the amount of savings required and the structure of their retirement planning strategies.

Advisor Strategy

- Educational Workshops: Host informational workshops focusing on retirement savings benchmarks and how to calculate future income needs.

- Personalized Savings Plans: Create customized savings strategies for clients, helping them understand how much they need to save to achieve their retirement goals.

- Regular Reviews: Offer regular financial check-ins to adjust savings plans as market conditions and personal circumstances change.

Gender Gap in Retirement Confidence Persists

Stats

The survey indicates a disparity in confidence between genders, with 59% of women feeling on track compared to 75% of men. Additionally, 70% of women find it challenging to understand how their savings will translate into monthly retirement income versus 56% of men.

Advisor Strategy

- Focused Education: Develop targeted educational content specifically for women, addressing their unique challenges and concerns about retirement savings.

- Holistic Planning: Emphasize holistic financial planning that includes income projections, budgeting, and long-term care considerations.

- Empowerment Sessions: Conduct confidence-building sessions and one-on-one meetings to demystify the retirement planning process for women.

Retirement Worries and Openness to Advice Are Emerging in Gen Z

Stats

The report shows that 77% of Gen Z respondents feel confident about being on track for retirement. However, there is still significant concern, with 69% worried about outliving their savings.

Furthermore, 63% of Gen Z do not fully understand how to manage their investments, and 47% are working with a financial advisor.

Advisor Strategy

- Early Engagement: Engage with Gen Z clients early on to instill good financial habits and the importance of early retirement planning.

- Educational Tools: Use digital tools and gamified learning platforms to educate younger clients about investment strategies and retirement planning.

- Regular Communication: Establish regular check-ins to adapt plans as their careers and financial situations evolve.

Gen X Feels Most Behind

Stats

The survey identifies Gen X as the generation feeling most behind in their retirement preparation, with 60% feeling on track but 63% expressing concerns about outliving their savings. Moreover, even among those who feel behind, only 31% are inclined to make catch-up contributions.

Advisor Strategy

- Catch-Up Strategies: Develop and promote catch-up saving strategies, including solutions focused on annuities.

- Debt Management: Provide comprehensive debt management and consolidation advice to free up more income for savings.

- Retirement Rescue Plans: Offer tailored “retirement rescue” plans that include high-impact saving strategies and investment reallocations.

Millennials Are Feeling the Squeeze

Stats

Data from the report shows that Millennials are under significant financial pressure, with 62% reporting credit card debt—the highest proportion among any generation—and 56% worried about outliving their savings.

Advisor Strategy

- Debt Reduction Programs: Design debt reduction programs and strategies that help Millennials balance debt repayment with retirement saving.

- Financial Planning Apps: Leverage apps to track spending, manage debt, and automate savings to ensure a balanced approach to financial health.

- Income Diversification: Explore additional income streams like side gigs or passive income opportunities to boost savings capacity.

Baby Boomers Grappling with Income Challenges

Stats

Among Baby Boomers, 68% feel on track with their retirement savings. However, issues remain, as two-thirds are still working, and 68% are uncertain about how much they need to save. Notably, 85% of retired Boomers acknowledged that secure income has a more significant impact than they anticipated.

Advisor Strategy

- Income Strategy Workshops: Offer workshops focused on retirement income strategies, emphasizing the importance of annuities, pensions, and Social Security.

- Longevity Planning: Provide robust longevity planning to ensure Boomers don’t outlive their savings, including healthcare and long-term care planning.

- Simplified Income Plans: Help retirees simplify their income plans, making it easier for them to manage and understand their income sources.

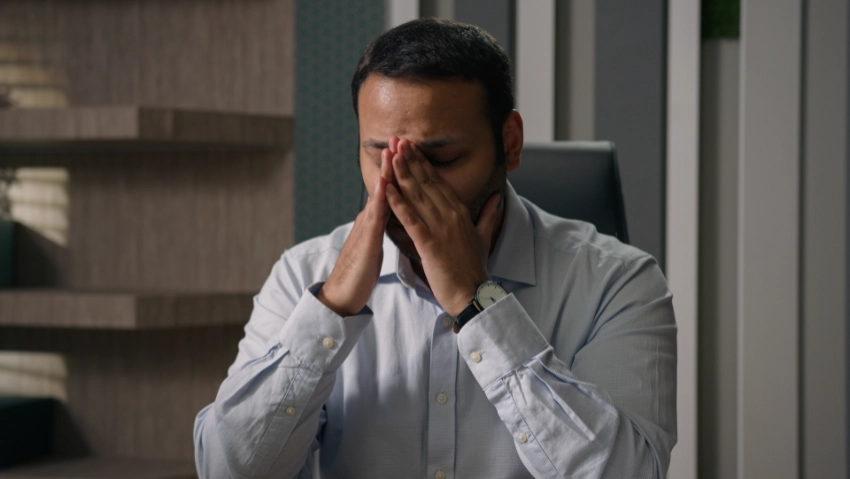

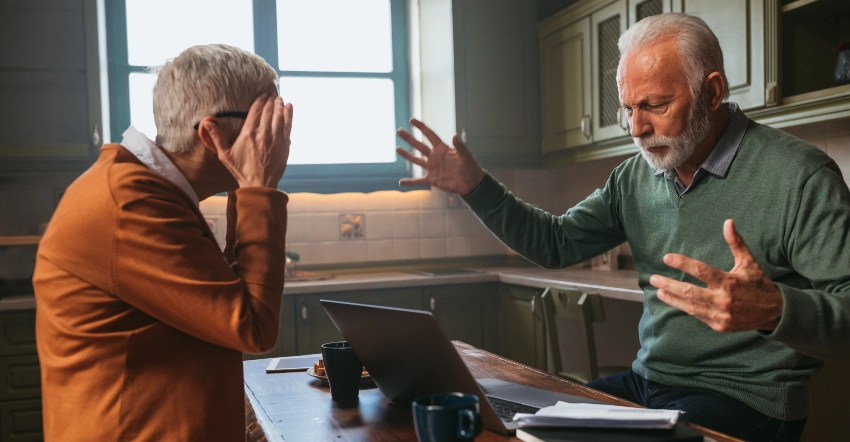

Retirement Worries Affect Mental Health

Stats

Retirement concerns are impacting mental health, with 60% of respondents worried about outliving their savings and 80% indicating that this worry affects their mental well-being.

Advisor Strategy

- Holistic Advisory: Incorporate mental wellness into financial planning, recognizing the emotional aspects of financial insecurity.

- Guaranteed Income Solutions: Promote guaranteed income products such as annuities to provide peace of mind.

- Client Support Programs: Develop support programs that offer both financial and mental health resources to clients.

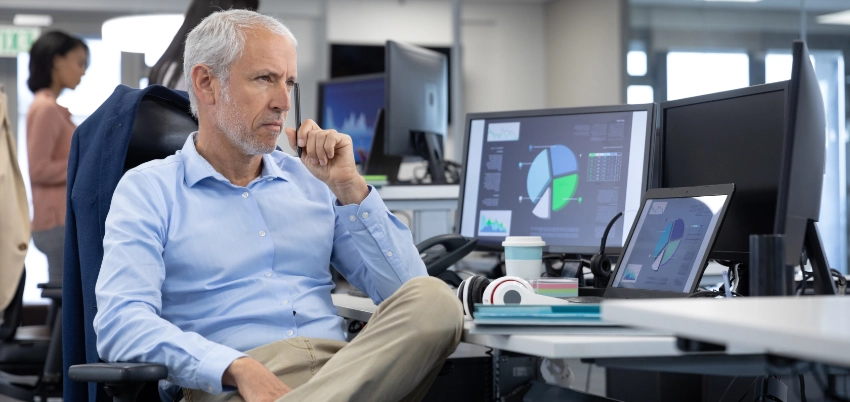

Confidence Falls Among Independent Savers

Stats

Confidence among independent savers, who lack access to workplace retirement plans, has decreased from 51% in 2023 to 47% this year. Many in this group rely on IRAs and taxable brokerage accounts, and half make investment decisions independently or with informal advice.

Independent savers are defined as employed full time with at least $5000 in assets set aside for retirement and no access to workplace retirement plans.

Advisor Strategy

- Targeted Outreach: Reach out to independent savers with educational resources and low-cost advisory options to build confidence.

- Partnership Programs: Partner with employers to provide retirement planning resources to employees without workplace retirement plans.

- Comprehensive Reviews: Offer comprehensive portfolio reviews and planning sessions to help independent savers optimize their strategies.

Comprehensive Reviews

Offer comprehensive portfolio reviews and planning sessions to help independent savers optimize their strategies.

At Empire Marketing Partners, we’re dedicated to providing you with the knowledge and tools needed to guide your clients through the complexities of retirement planning. Remember, a well-informed client is a confident client. Let’s work together to turn retirement uncertainties into plans of action.

If you found these strategies helpful, stay tuned for more insights and connect with us for tailored advice and support.